Événement Conférence

Innovating and Unlocking Finance for Nature-based Solutions

11 May 2023

16:00–17:30

Lieu: Palais des Nations | Room XXIV & Online

Organisation: European Union, Union Internationale pour la conservation de la nature, Geneva Environment Network

This event hosted a discussion on the European Investment Bank upcoming report on “Access to Finance for Nature-based Solutions” highlighting the role of public and private sectors in accelerating and unblocking pathways for innovative financing Nature-based Solutions. The event was co-organized by the International Union for Conservation of Nature and the Geneva Environment Network, with the support of NetworkNature and the EU Commission.

About this Event

The vital contribution of nature and its services to social and economic development is undeniable. It is estimated that $44 trillion of economic value generation is moderately or highly dependent on ecosystem services, which corresponds to over half of traditional global GDP.

The global recognition of Nature-based Solutions (NbS) with the adoption of the multilaterally agreed definition at the Fifth Session of the United Nations Environment Assembly (UNEA-5) is now followed by the inclusion of the term in the text of four environmental conventions, including the United Nations Framework Convention on Climate Change and the Global Biodiversity Framework. Now is the time to boost the implementation of NbS interventions at scale. Currently, approximately 133 billion dollars are channeled into NbS interventions, and investments must at least triple by 2030 to achieve land degradation neutrality, climate change and biodiversity targets.

NbS finance is also substantially more dependent on the public sector, unlike in climate finance where private sector investment accounts for most capital flows. At present the business model and return-on-investment for NbS is not clear limiting interest from traditional financial institutions. Even for ‘patient’ impact investors the return-on-investment is often not clear enough to secure investment. To generate even more financially secure NbS interventions and strategies, investors need to come to the table. Donors and development partners, such as multilateral development banks, can support NbS project preparation by providing resources and technical assistance that can transition projects into more financially secure models.

Co-organised by the International Union for Conservation of Nature (IUCN) and the Geneva Environment Network – within the context of the EU NetworkNature project – with the collaboration of the European Commission, this event shared key messages from the European Investment Bank’s upcoming report of “Investing in nature-based solutions: State-of-play and way forward for public and private financial measures in Europe” followed by a discussion on the role of public and private sectors in accelerating and unblocking pathways for innovative financing NbS.

The event was followed by a reception.

Speakers

Guy HUDSON

Senior Advisor, Innovation Finance Advisory, European Investment Bank (EIB)

Karin ZAUNBERGER

Policy Officer, European Commission

Fiona FRICK

Managing Partner, CIRCE INVEST

Chris BUSS

Director, Centre for Economy and Finance, IUCN

Liesel VAN AST

Deputy Head, UNEP Finance Initiative

Veronica RUIZ

Resilience Programme Manager, IUCN | Moderator

Highlights

Video

The event is livestreamed from Palais des Nations and via Webex.

Livestream from the room

Summary

Welcome Remarks / Setting the Stage

Veronica RUIZ | Resilience Programme Manager, IUCN | Moderator

- NetworkNature project encompasses over 40 Nature-based Solution (NbS) projects funded by the EU Commission.

- This event is part of a two-day workshop on how to unlock finance and investment for NbS.

- Why NbS? We are in the face of a triple planetary crisis. Nature and people go hand-in-hand. NbS can be an impactful way of tackling this crisis, support SDGs, and generate financial and social investments returns.

- Despite this, NbS face multiple difficulties: gaps in knowledge, means of cooperation, and implementation, clear lack of financing as a real obstacle.

- NbS will require unlocking investment, funding from diverse pool of actors.

- The G20 economies invest $120 billion per year on NbS, but there is a need to triple this investment at $384 billion per year by 2025 to contribute to tackling climate, biodiversity and land degradation goals (UNEP, 2022). We need to speed up investment.

Key Messages from the Upcoming EIB Report

Guy HUDSON | Senior Advisor, Innovation Finance Advisory, European Investment Bank (EIB)

- The EIB report on Nature-based Solutions (Investing in nature-based solutions: State-of-play and way forward for public and private financial measures in Europe), produced for the European Commission’s Directorate-General for Research and Innovation, aimed to look at the challenges and opportunities of investing in NbS.

- The report itself has key components:

- A deep-dive of NbS actually in place in the EU compiled a list of nearly 1,400 NbS active. Whilst there are major data gaps, this is the most serious attempt of drawing up a list of NbS in the region.

- Three-fourths of these projects were located in the urban ecosystems, followed by forestry and agriculture.

- An assessment of NbS across these ecosystems, we are able to tell the financing gap, and what needs to be done to restore these ecosystems.

- Building on these (28) databases, we supplemented this with a market survey of financial sector experts asking them about natural capital and NbS. From 200 questionnaires sent, 110 responses were received. 58 interviews were conducted with banks, insurers, asset managers, and financial investors.

- A deep-dive of NbS actually in place in the EU compiled a list of nearly 1,400 NbS active. Whilst there are major data gaps, this is the most serious attempt of drawing up a list of NbS in the region.

- Key findings:

- NbS funding is still dominated by public sources. Within the EU, over 60% of funding is derived from EU programs at around 200-250 million euros. This is reflective of how the biodiversity agenda has grown in visibility over this period. It also reflects of the raised profile of NbS and biodiversity and restoration over the past 5 years, driven by the European Green Deal, EIB’s roadmap, and climate adaptation.

- The average project size encountered was very small. This is an operational challenge for the finance sector when most projects under 10 million euros represent quite a challenge: it’s inefficient for financial investors to engage in small, non-replicable projects. Average project sites were under 2 million euros, and 44% were under 1 million euros.

- Climate change agenda provides a real opportunity for the concept of “natural capital” to gain ground. There are policy underpinnings we can build more robust business models.

- There is a need for continual investments from across the spectrum: from the seed stage, investment capital, technical assistance, early growth capital, and flexible debt instruments and innovative aggregators of projects (putting projects together), in the hopes of mainstreaming natural capital and NbS into larger investment programs.

- Crucially, grants will continue to be essential in this space. Streamlined coordination with EU and national grants combined with financial instruments continue to be very important.

Current Developments and Opportunities

Karin ZAUNBERGER | Policy Officer, European Commission

- Science is clear, we are in an interlinked triple planetary emergency. Action during this decade will be decisive.

- NbS deliver multiple benefits for people, nature, and planet. They are also readily available.

- In 2019, the EU launched the European Green Deal, a holistic roadmap for just transition, leaving no one behind, and following a do-no-harm principle. Since then, several initiatives and action plans have been initiated, including the Biodiversity Strategy for 2030 and its urban greening plans, and the proposed Nature Restoration law, among others. NbS is embedded in all these initiatives. This means NbS contributes to these objectives.

- These also open opportunities for Nature-based enterprises, which open new markets. The EU is a member of the Enact Partnership for Nature-based Solutions that was launched last year, which is a platform that can strengthen implementation. Funding instruments in this can only be used for NbS. Several hundred millions have already been invested in the development and demonstration of NbS. The European Partnership on Biodiversity is currently preparing a call for proposals on NbS.

- The concept of working with nature rather than against has been around for quite some time. Terms have also been used to denote this: green and blue infrastructure, ecosystem-based adaptation and disaster-risk reduction, natural water retention measures, ecological infrastructure, among others. These share the same rationale that healthy ecosystems deliver the crucial ecosystem services on which our societies and economies depend. The implementation of NbS is crucial.

- NbS implementation is labor-intensive, but this is considered as high cost. Decent work in NbS can provide opportunities to create jobs and can be considered a key asset. People can become a part of the solution.

- Implementation needs investment. Humanity’s current operational system is the neoclassical economic system driven above all by financial return on investment, which does not appreciate the merits of benefits that aren’t costed. Rather than using the traditional cost-benefit elements, maybe we can see NbS as an investment to address the triple planetary emergency, in our common future and home.

- It is important that we are working to capture venture-based values to make NbS valuable, yet we also need to strive for a sustainable economy where people’s health, well-being and livelihoods, and the protection and restoration of ecosystems at the heart of the incentive.

- NbS are not a panacea. We need to accelerate NbS alongside other solutions. To quote the UN Secretary-General, we need everything, everywhere, all at once.

Fiona FRICK | Managing Partner, CIRCE INVEST

- What can be done to increase impact and flows towards NbS?

- Asset managers aim to permit flows from investors to projects, companies, and governments, and vice versa. The responsibility is to ensure that the flow is going in the right direction, i.e., towards sustainability.

- The rise of environmental, social and governance investing (ESG) is extending the fiduciary duty of asset managers. When you speak to the CIO of an institutional clients (pension funds, insurance companies, etc.), the primary fiduciary duty is to help age the world’s population graciously.

- ESG goals (financing long-term needs of the real economy sustainably, influencing companies through voting and engagement, and helping solve social and environmental problems) can only be done once the original goal has been pursued. How can asset managers influence? Make these fiduciary dutiable and ensure investor responsibility doesn’t go only to clients they serve, but for climate and society. Asset managers are also the main owners of companies because of regulation that holds them to vote and engage with them, going towards sustainability and social responsibility.

- The business sector already finds that biodiversity loss and climate change to be the most precious risks to society, and has understood that everything has to be done to avoid that risk.

- As of today, money going to sustainable strategies also now consider the positive impact investments have on nature and society, and not just those that avoid risks.

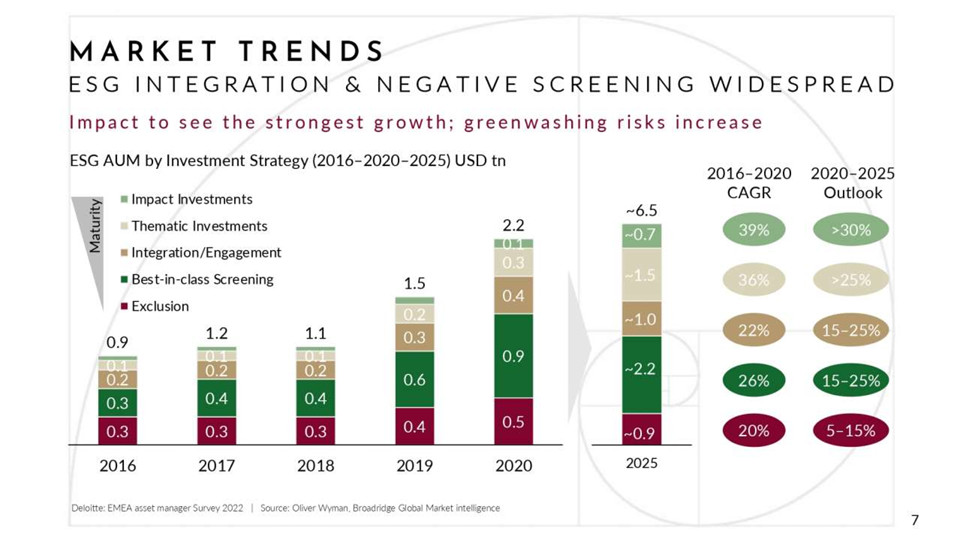

- Sustainability investment has been going up, but it has grown mainly by exclusion – when a company is excluded from the portfolio because of possible damaging environmental and social criteria – and best-in-class screening – investing in companies that is thought to be better than others. The latter is important as it allows asset managers and investors to have more pressure points on companies through voting.

- The part that needs to grow is impact investments, as it is associated with higher risks and is generally illiquid (going into private equity or venture capital funds) making them have a small allocation in the institutional requirement today. How can we make sustainable products be more than just impact, and make them mainstream?

- What do investors want from impact investing? Investing in opportunities provided by the shift, impact and returns, demonstrable impact (through measures and KPIs), and an exchange of knowledge. “We need to speak the same language in order to invest accordingly.”

- What is missing today is data on biodiversity, which is currently extremely limited. There are also not enough data at the level of public companies, such as CDP data (18,600 companies reported on climate change, but only 3,900 reported on biodiversity). Moreover, reporting often consists of narratives with little quantitative information, focusing on specific projects that restore biodiversity loss. This is why TNFD can be really helpful, so that companies can report properly.

Chris BUSS | Director, Centre for Economy and Finance, IUCN

- The policy framework is an essential ingredient to drive forward investment in NbS, which is already existing at an MEA level. The initial concept of the initiative to report on progress of NbS is driven by the success coming from Glasgow and the link between nature and climate. It’s also critical that this is underpinned by the right levels of action.

- We need to push much more implementation at scale, moving beyond projects. The risks presented to businesses can help drive NbS to the fore, such as in forest landscape restoration and work in agriculture. NbS present great opportunity to reduce risks to land systems and make them much more resilient to climate shocks.

- Business guidelines on how NbS can make economic sense. We need to move beyond NbS projects and integrate them into intersectoral approaches to address the problems we need to address.

- Going to scale at a level of quality is critical. The IUCN NbS Standard can help ensure that it is a credible NbS and will help guide practitioners and policymakers to understand what an NbS really is.

- The biggest threats to NbS as a concept is the misclassification of climate carbon capture schemes as NbS. We need to drive NbS to much better practices, as a climate solution does not automatically equate to NbS, as there are certain criteria that need to be met. Having the quality of assurance is critical.

- Another point of success is inclusiveness in the delivery and design of NbS, particularly on the ground. We need clear stakeholder process integrating local communities and indigenous peoples in the design and implementation processes.

- On issues of scale, we talk about the landscape level. Understanding who pays for what, is an important question in delivering NbS.

Liesel VAN AST | Deputy Head, UNEP Finance Initiative

- The last 5 years has seen a shift in framing nature from looking at business impacts on nature, to understanding that we all depend on nature. One of the most recent pieces of evidence is a report of PwC that looks at the changes in the environment and the changes in the economy. It is not something that should be sidelined in economic development, but an integral part of it.

- The PwC research finds that more than half of most GDPs depend and build on nature. Healthy ecosystems and biodiversity have far reaching implications on value chains (in 163 economic sectors analyzed, more than half of the market value of companies is really dependent on nature).

- UNEP’s report, State of Financing for Nature, shows that 154 billion USD flows annually for NbS, a tiny amount in the context of the global economy. This needs to be more than doubled to 384 billion USD by 2025 and 484 billion USD to 2030.

- With sufficient finance, NbS can help cost-effectively achieve climate and biodiversity goals and land restoration targets. Investments to these contribute to national biodiversity strategies and action plans, climate goals, and land degradation neutrality targets.

- If we mobilize 11 trillion USD in assets cumulatively by 2050, we can achiever our goals. Strong action before 2030 is paramount at this stage.

- Many of the public budgets for nature conservation are underfunded. Global domestic budgets for biodiversity conservation amount to 76b USD. Compared to this, nature negative expenditures far exceed NbS at 500 billion to 1 trillion USD. These flows undermine efforts to achiever critical environmental targets – a huge lost opportunity. The WEF estimates that nature-positive policies can attract more than 10 trillion USD in new annual business value and create 395 million jobs by 2030.

- Policymakers, financial institutions and businesses are starting to recognize the need to come together and scale up NbS. The private sector investment is around 26 billion per year, a fraction of what is needed. We need to scale up impact investment, investment in sustainable supply chains, and much more innovation in private and public financing.

- The Kunming-Montreal Global Biodiversity Framework (GBF) is a major milestone in the global drive to reverse biodiversity loss. It makes it clear to financial institutions to act on nature as it did on climate at a more accelerated rate (see Goal D (alignment with public and private finance goals with intent to achieve nature and biodiversity goals), 8, 14, 15, 19).

- Businesses and financial institutions have a key role to play: for companies to monitor, assess, and disclose dependencies and impacts on biodiversity, reduce negative impacts, and increase positive ones. They cannot continue business-as-usual.

- NbS features specifically in Target 8, particularly in DRR, climate change mitigation and adaptation.

- Transforming financial flows to nature positive and aligning global public and private financial flows to targets of the biodiversity goals require ambitious science-based targets across economic sectors and enhanced disclosure and accountability.

- UNEP FI convenes 500 financial institutions to integrate sustainability into their businesses. We’re helping guide practical action into the financial sector.

- For banks, in particular, we work signatories for the Principles for Responsible Banking, and a report released that sets up implications of the GBF on banks and highlights key steps they can take to contribute to the framework, such as building critical capacity internally on nature and biodiversity, and establishing executive governance that will drive strategy.

- Map and assess banks’ exposure to risks and dependencies on nature in priority sectors such as food, agriculture, and mining. Final version of the Taskforce on Nature-related Financial Disclosures (TNFD) will be released in September 2023.

- Work on science-based targets.

- Key element for banks is developing policies and strategies on biodiversity and drivers of biodiversity loss (ex. Deforestation, high dependent sectors).

Open Discussion

Q: Impact is lacking when it comes under the label of green investment. Literacy on NbS is also appreciated on what they are on the ground because it’s really difficult to get this be understood. There is also a need to differentiate between the amount invested and the impact these have. What should the EIB do going forward to nudge the investment community to be part of this movement to shift towards having real impact?

Guy HUDSON | The strategy for market-based instruments back in 2014 was aggregation and getting critical mass, and mainstreaming. As business models are intrinsically tied to nature, they were able to easily embed NbS components in larger investment components. Willingness to care is also important.

Q: What are the key assets that can be achieved through NbS implementation?

Karin ZAUNBERGER | NbS are easily scalable across all levels. It also needs many people involved for them to be implemented, helping them reconnect with nature and bring back nature into our lives.

Q: What is required for the essential uptick of NbS that is sustainable at the long-term?

Chris BUSS | In addition to what has been mentioned, increasing the understanding of the capacity of NbS and knowledge base, and how this can be presented to different sectors to ensure what is being achieved is clear. Clearer language on the matter is essential.

Q: If impact matters to NbS, won’t we see this “impact” from carbon markets?

Liesel VAN AST | It’s more about biodiversity credits, which has learned from carbon markets. There is an initiative called the Biodiversity Credit Alliance, co-facilitated with UNDP, that engages stakeholders on setting norms on such biodiversity credits, having high integrity biodiversity credits and nature markets, identifying biodiversity credit principles, co-developing digital standards, and producing papers.

Chris BUSS | NbS cannot be substitutes for carbon credits. We see many companies using NbS as climate solutions and carbon capture, but it doesn’t excuse actual change in practices, such as reducing emissions. This is the messaging that needs to be brought across.

Remark: Social dimensions in implementing NbS have to be included.

Liesel VAN AST / Chris BUSS | Human rights, inclusion, and just transition have to be a part of the process of implementing NbS. Inclusiveness is not a choice. It has to happen.

Q: What are the opportunities and challenges does blockchain technology have in the financing of NbS?

Guy HUDSON | Blockchain is a useful tech for certification, which can be applied to having a true global register of assets.

Liesel VAN AST | Not really related to blockchain, but there is a Sustainable Digital Finance Alliance that looks at the intersection of sustainability, digitalization and finance, among others.

Q: When it comes to shareholder engagement, how is this addressed in NbS and finance?

Liesel VAN AST: The asks and expectations by shareholders are becoming more and more granular.

Closing Remarks

Karin ZAUNBERGER | We know what needs to be done. We have means, instruments, tools, financial and human resources. The question is, will we be able to do what needs to be done in the short time available? This decade is the ultimate test wherein we test whether we deserve the name we have given to ourselves: homo sapiens sapiens.

Liesel VAN AST | We’re just at the beginning of a journey, and we’re at a critical stage. Now is the time to invest and align with nature-positive outcomes. There needs to be an alignment of public and private finance systems for us to reverse biodiversity loss.

Guy HUDSON | Appealing for streamlined coordination of resources that have been so keen to bring us up to this point. My true hope is that the nature agenda can follow behind the climate agenda. We need critical mass.

Chris BUSS | The repurposing and redirecting of the trillions is just as big an opportunity. If we redirect this in the right way to the right purpose, using NbS, it’s a twist to change the direction.

Veronica RUIZ | The message is clear: we have to work together, we have to join forces.

We need to increase visibility on dissemination of NbS in the private sector. Alignment and identification of risk, we are moving very fast. We need to move beyond project types, and scale these up to ensure larger types of investment, creating incentives while avoiding greenwashing.

Photo Gallery

Documents

- Presentation

- Investing in Nature-based Solutions: State-of-play and way forward for public and private financial measures in Europe| European Investment Bank (EIB)| 8 June 2023

- State of Financing for Nature | UNEP FI | 1 December 2022

- Banking on nature: What the Kunming-Montreal Global Biodiversity Framework means for responsible banks | UNEP FI | May 2023

- Stepping Up on Biodiversity: What the Kunming‑Montreal Global Biodiversity Framework means for responsible investors | UNEP FI | April 2023

Links

- Nature-based Solutions | IUCN

- Nature-based Solutions | Geneva Environment Network